I believe that every small business needs an accountant (“well you would!” I hear you shout). Time for me to make my case then.

Sole Traders and small portfolio Landlords quite regularly see an Accountant as an unnecessary expense. Some of these may well be finance experts so I will let them off. But how many of us would buy a house and not get a solicitor involved, for example?

And we do so because they are the experts, and they will make sure it gets done correctly. Good ones hold our hand and help us at every step.

I would never consider plastering a wall or fixing a plumbing leak in my house because it’s not my strength. An expert can do it better, quicker and save me time and money in the long run.

Yet people often view Accountants very differently.

A conversation I had

A little while back I had one of my complimentary discovery calls with a new business owner. He had started around 3 months previously, and had taken on a lot of work with a contact of his, so he had gotten off to a great start.

He was working 7 days a week and his turnover was high. But he still felt that more money was going out than coming in.

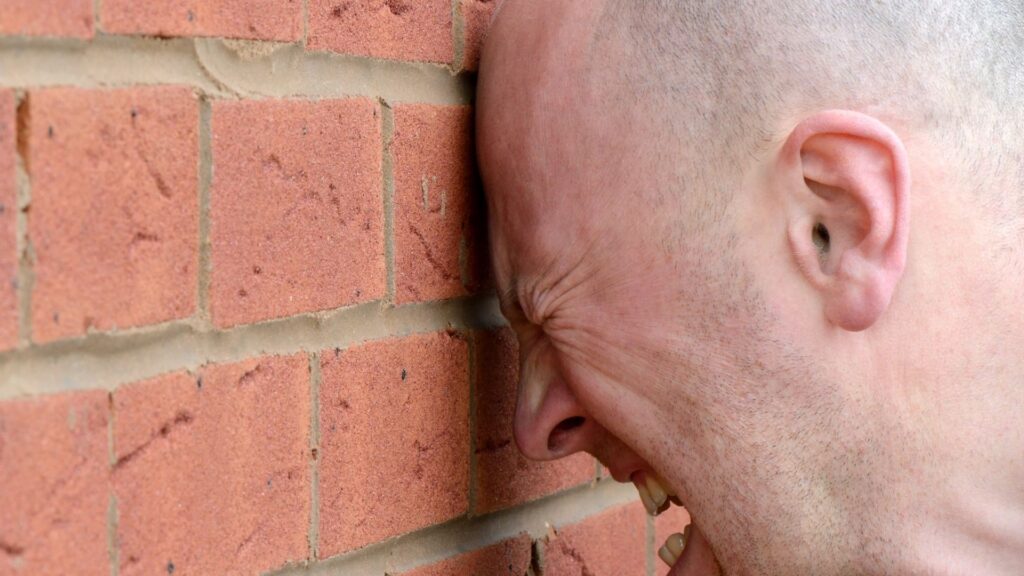

He didn’t have time to do his books but knew he was working for less than he wanted and suspected he was actually making a loss. He was stressed that his books had not been done and he didn’t have the time to do them. He was stressed because he wasn’t making the money he had hoped for (or needed). His receipts were piling up in his van or getting lost. His bank account was emptying.

I offered to help get his books up to date so we could see what was really going on, take the stress of having to do his own books (or in this case not doing them at all) away from him and help him work out his costs to help him price up future work and see where he could improve his overheads.

He turned me down. It was a waste of money in his eyes.

A business owner prepared to lose money rather than pay the expert to help him get it right and help make his business worth doing. A businessman prepared to be completely stressed out because an Accountant is not worth it.

I have no doubt I would have made a difference to him and his business because that is what I do. His business and his personal life would have benefitted and he would have gained far more than the fees I quoted, both in terms of business profits and his own health.

Each to their own as they say.

Why are Accountant’s seen differently?

Are we, or is it just a perception that I have? My theory is that business owners and landlords alike do not see the benefits an Accountant can provide. There is no physical product to display and the costs outweigh any benefit they get.

I have often complained about the general use of the word Accountant. To call yourself a Solicitor you must have the full qualifications, this means the client does at least know that they are dealing with a professional who (should) know their stuff.

But anyone can call themselves an Accountant. I believe this leads to a watering down of the help and benefits we can provide and a ‘race to the bottom’ in pricing terms. Those that need an Accountant, purely to meet their statutory requirements, go for the cheapest option and, as they say, get what they pay for.

That’s not to say a qualification guarantees great service and benefit. Like any other profession or vocation, there are some qualified Accountant’s that I would not let anywhere near anything I was working on. Equally one of the best Accountants I ever worked with (sadly passed away far too early) was not qualified (for personal reasons he ran out of time when studying for his exams). He did, though, have 30+ years of working within an accountancy practice.

So I speak (or write in this case) for myself. I’m not the cheapest Accountant you will find. I stay away from clients who just want a “cheap as you can make it – and make sure I pay no tax” service. I’m also far from the most expensive by the way.

Here's my case, your honour

As a fully qualified Accountant, with so many years of experience, I genuinely believe I can help business owners, landlords, the self-employed and anyone looking to start-up a new business by taking the journey with them. Explaining their numbers, working with them to make the best decisions for their business, and not just for tax.

Here are just a few ways a good accountant can help you:

- Save you time to concentrate on your business and doing what you do best

- Ensure you can sleep peacefully knowing all your accounts and tax compliance are taken care of

- Explain your numbers, so we can work together to make the best decisions for your business

- Reduce your stress levels which has to be good for your health

- Provide you with a trusted advisor with whom you can talk things through

- Minimise your tax liability and stay best friends with the taxman

- We work with business owners in many different fields and can make introductions to others who can help you

So that, in brief, is my case for the accountant. If you don’t have your own accountant, then please think again. If you do and you are still not getting these benefits, then you have the wrong one!

And as for no physical product? Well maybe I can improve your business and save you time and money so that you can treat yourself to that something you always wanted, or just give you some precious time to spend with your friends or family.

Don't ever let your business get ahead of the financial side of your business. Accounting, accounting, accounting. Know your numbers.

Tilman J. Fertitta

If you need help with your small business please get in touch. You can book a complimentary call with me to discuss your business issues and we can work together to help you obtain the success you deserve.