Did you read the title and immediately answer yes or no?

If you said “no” you may be surprised by the truth (or lack of it) of your answer.

Ok, so it is a bit of a trick question. But if you think tax avoidance is purely for the rich who can afford grand schemes you would be wrong. And if you’re screaming loudly that you would never do such a thing then I have a very simple question for you.

Have you got or ever had an ISA? If the answer is yes, then you are guilty of tax avoidance.

Guilty, of course, is not the right word for it. You are, in fact, perfectly within your rights to do so.

The common mistake in answering this question is understanding what tax avoidance is, its scope, and the difference between tax avoidance and tax evasion.

As an accountant I have a responsibility to my institute (ICAEW) to know where to draw the line. More importantly, in my view, I have my own code of ethics which I will not go beyond. As a taxpayer (yes, I’m one too) understanding what is meant by these, and where you stand on them, dictates your tax policy, and your future relationship with both HMRC and your accountant.

Tax Avoidance – Simple Tax Planning

Tax avoidance has a wide scope. Starting with the legitimate minimising of taxes using methods that are legal and form the bases of good tax planning. These include such things as: –

- The use of ISA’s to avoid tax on interest or capital growth

- Paying towards a personal pension scheme to take advantage of the tax benefits

- Claiming legitimate expenses through your business or rental portfolio

- Structuring your business correctly, i.e. limited company or sole trader

These are reasonable measures to take in any tax planning exercise, and I would go as far as to say it would be a mistake not to take advantage of these.

Tax Avoidance – Getting Aggressive

According to government website GOV.UK: “Tax avoidance involves bending the rules of the tax system to gain a tax advantage that Parliament never intended. It often involves contrived, artificial transactions that serve little or no purpose other than to produce this advantage. It involves operating within the letter, but not the spirit, of the law.”

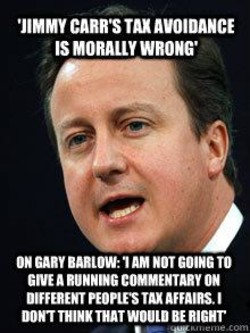

This is the area where everything gets blurred and the moral argument comes into play. Generally, it is split into 2 sides.

- It is legal, therefore it is the Government’s problem, and they need to change the law. You can’t blame anyone for exploiting the rules.

- It is fundamentally wrong and HMRC need to track these people/businesses down and make them pay.

It is fair to say that aggressive tax avoidance schemes are generally aimed at the more wealthy amongst us. After all, they have the most tax to save, and the cash to afford paying for them (and defending them). But it is wrong to say only the rich have ever been involved in tax avoidance schemes.

Is a change to the law fair?

Their use by some lower paid workers has helped those trying to oppose the backdating of changes to the law, that not only prevent these schemes being used from now on, but also catch people and businesses that have used them in the past.

There are some lower income earners, including some NHS workers, who could be greatly affected by this.

In some ways this has confused the argument. Whilst sympathy for the rich who have aggressively used these schemes may be in short supply, are we ok with causing hardship for lower paid workers who have been (badly) advised to make use of them? Were they even aware of the risks involved or, no matter how they were advised, should they have known better?

Is it ever fair to backdate changes to the law? And, if so, should everyone be treated the same?

The fact (perhaps the uncomfortable truth) of the matter is tax avoidance is not illegal and that is the case for the defence.

It is however against the spirit of the law, and that’s why we must all decide where to draw the line.

Tax Evasion

Tax evasion is, put simply, a criminal act to avoid paying tax. This includes:

- Not declaring income for tax purposes

- False expense claims

- Taking cash to avoid vat

Tax evasion is illegal, and that’s the end of that argument!

Where do I stand?

There is often a fine line between legitimate and aggressive tax avoidance.

As an accountant and tax advisor I will always use the simplest forms of tax avoidance to help my clients. Does that sound controversial?

Why would I tell a client to set their business up as a sole trader, if it is clearly more tax beneficial to set it up as a limited company? Would I say, “don’t make pension contributions, it’s tax avoidance!”? Of course not. I would be out of a job for a start.

I draw the line when tax avoidance starts to go against the spirit of the law. In my opinion business decisions should be about what the business needs to do first. Once that decision is made then look at the best way to structure it for tax purposes. Even the Ltd company vs Sole Trader decision should not be made solely on the grounds of tax.

This is the opposite of aggressive tax avoidance, where the sole purpose is to avoid tax and then work out how to make it look like there’s a legitimate business reason by placing the right wording in the legal documents. There is in fact no business purpose behind it at all.

I believe in advising my clients to get the best tax position they can whilst staying best friends with the taxman. Going further than that would go totally against my personal values and give me lots of sleepless nights. Ida would get less walks because I’m too tired, and we definitely cannot have that!

Unmarried couples should get married - that's an excellent tax avoidance measure, if a bit drastic.

John Whiting